In today’s fast-paced financial landscape, effective wealth management is more crucial than ever. With the rise of technology, particularly private asset management tools, individuals can now navigate their financial futures with greater ease and efficiency. This blog will explore how these tools are shaping the future of wealth management, providing clarity and enhancing the overall experience for clients.

Understanding Private Asset Management Tools

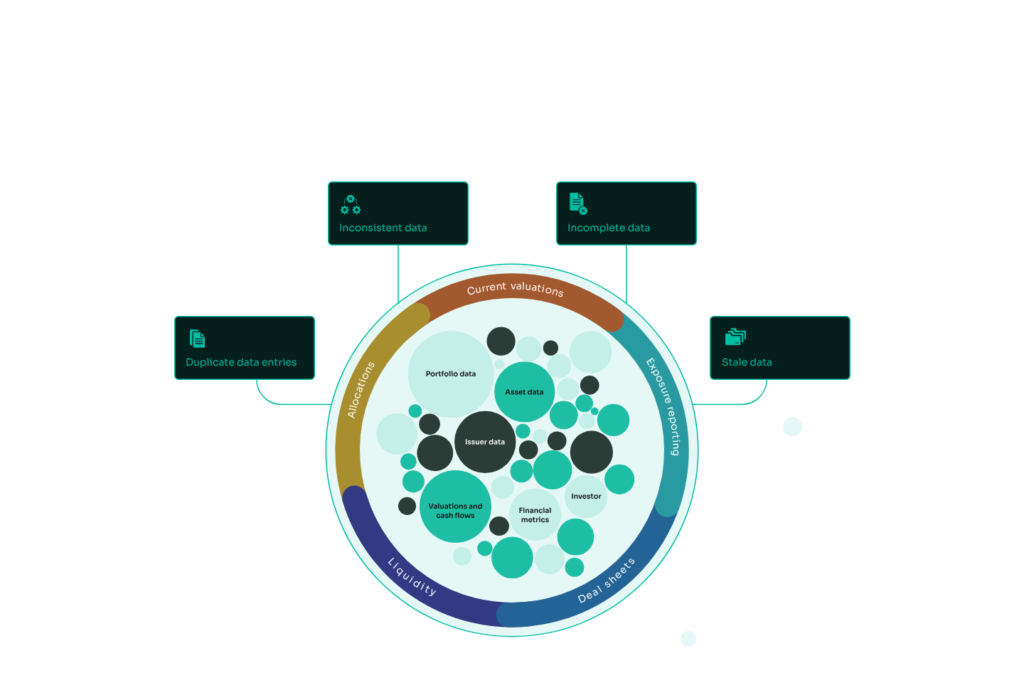

Private asset management tools are digital platforms that offer personalized financial solutions tailored to an individual’s investment goals and https://jun88p.com/ risk tolerance. These tools encompass a wide range of features, including portfolio tracking, financial planning, investment analysis, and risk assessment, allowing users to manage their assets seamlessly.

As the demand for financial independence and transparency grows, these tools are becoming increasingly popular among high-net-worth individuals and families, seeking effective ways to oversee their wealth.

Streamlining Financial Planning

One of the most significant benefits of private asset management tools is their ability to streamline financial planning. Traditional wealth management often involves extensive paperwork and numerous meetings with financial advisors, which can be time-consuming and stressful. However, modern tools provide a more efficient and user-friendly experience.

Real-Time Data Access

These tools allow users to access real-time data on their investments, enabling them to make informed decisions quickly. With up-to-date market information at their fingertips, individuals can assess their portfolios’ performance, adjust strategies, and seize opportunities as they arise.

Integrated Financial Dashboard

A centralized dashboard integrates various financial accounts, giving users a comprehensive overview of their financial health. This feature eliminates the need to log into multiple platforms, simplifying the management process. Users can easily track their net worth, analyze spending habits, and monitor investment growth—all in one place.

Automated Financial Planning

Advanced algorithms power many asset management tools, allowing for automated financial planning. Users can input their financial goals, and the tool will generate a tailored plan, suggesting investment strategies and budgeting techniques. This automation not only saves time but also reduces the likelihood of human error in financial planning.

Personalized Investment Strategies

The future of wealth management is increasingly focused on personalization, and private asset management tools play a crucial role in this shift.

Tailored Investment Recommendations

These tools utilize data analytics and machine learning to provide personalized investment recommendations based on individual risk tolerance, investment goals, and market conditions. Users can receive tailored suggestions that align with their financial aspirations, enhancing their chances of achieving long-term success.

Risk Assessment and Management

Private asset management tools often include robust risk assessment features that evaluate potential investment risks. By analyzing historical data and market trends, these tools help users identify and mitigate risks in their portfolios. This proactive approach ensures that investors are better prepared for market fluctuations and economic uncertainties.

Enhancing Communication with Advisors

While private asset management tools offer numerous benefits, the human element of wealth management remains essential. These tools facilitate better communication between clients and their financial advisors, leading to more informed decision-making.

Collaboration Platforms

Many tools come equipped with collaboration features that enable clients to share their financial data with advisors securely. This transparency fosters a stronger advisor-client relationship, allowing for more in-depth discussions about investment strategies and financial goals.

Performance Tracking and Reporting

Regular performance tracking and reporting allow clients to stay informed about their investment progress. Advisors can leverage these insights to adjust strategies as needed, ensuring that clients remain on track to meet their financial objectives.

The importance of Education

As private asset management tools continue to evolve, educating clients on how to utilize these platforms effectively is crucial. Many tools offer educational resources, including tutorials, webinars, and articles, empowering users to take control of their financial journeys.

Financial Literacy Initiatives

Increasing financial literacy is essential for maximizing the benefits of private asset management tools. By understanding the fundamentals of investing, budgeting, and risk management, clients can make more informed decisions and confidently navigate their financial futures.

Community Engagement

Some platforms foster community engagement through forums and discussion groups, allowing users to share experiences, strategies, and insights. This collaborative approach not only enhances learning but also builds a supportive network of like-minded individuals.

Conclusion: Embracing the future of Wealth Management

The rise of private asset management tools is transforming the landscape of wealth management. By simplifying financial planning, providing personalized investment strategies, and enhancing communication with advisors, these tools empower individuals to take control of their financial futures. As technology continues to advance, the future of wealth management promises to be more accessible, efficient, and tailored to individual needs.